Read More

Investor Update

November 2022

The 2022-2023 Federal Budget’s Housing Accord pledges to construct 1 million new homes from 2024 to 2029. The deal is an agreement between levels of Australian government, institutional investors and the construction sector. Though, what does this result in for the current rental crisis?

Let’s take a look.

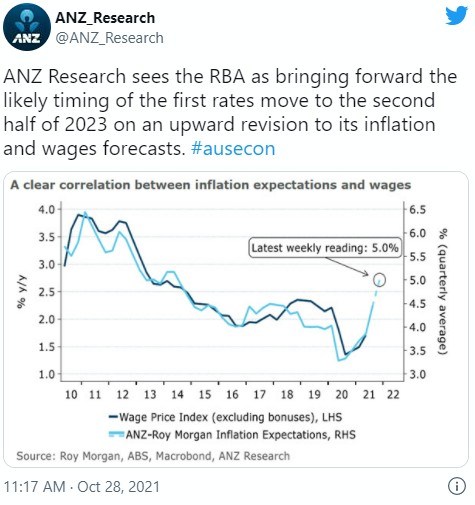

There are minimal signs indicating the current rental market growth will slow down anytime soon. Interest rates are continuously rising with the RBA announcing another 0.25% increase this week, bringing the current cash rate to 2.85%. Investors are feeling the squeeze which may be enhancing pressure on rents to counteract increasing mortgage repayments. Whilst there is pressure on increasing rents from investors, the federal government also raised the cap on it’s permanent intake of international migrants to 195,0000 for the next year. This will further increase tenant demand in the already heightened rental market. Resultingly, it seems the new Housing Accord is mainly targeting housing supply issues.

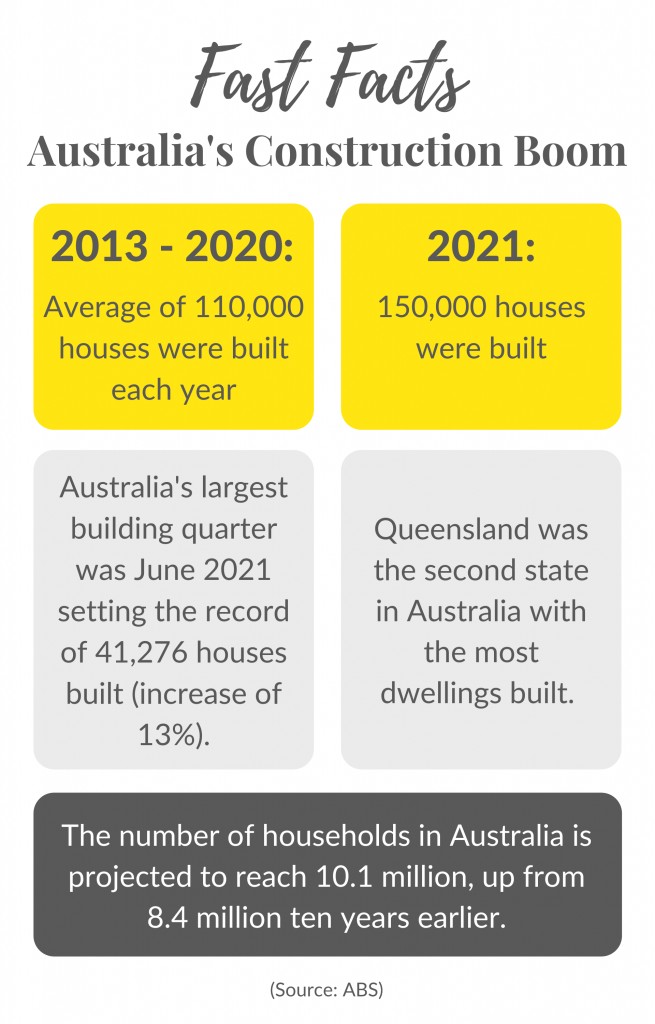

The budget references a target within the Accord to build one million new homes over five years, starting in 2024. Each state and territory has committed to build another 10,000 dwellings for affordable housing. The Housing Industry Association believes that this Accord will help to maintain a stable level of housing supply across Australia. Though some say, we’ve done this before – it’s no different to past decades. In fact, the Australian Bureau of Statistics (ABS) shows that 974,732 homes were constructed in the five years to June 2022, and an average of 1,010,723 have been completed on a five-year basis since 2017. Perhaps this ambitious housing supply solution is not all that ambitious after all?

However, it’s worth noting that past decades saw strong price incentives for developers, HomeBuilder grants and the off-the-plan apartment boom in mid to late 2010’s assisting in this strong development. The construction sector now faces a ‘construction crisis’ with builds not being finished, worker shortages and supply delays. The ABS data suggests new build completions have already started to reduce since the recent building boom and new dwelling approvals have generally been taking longer. Although it doesn’t sound ambitious looking at the past decades, the challenges the construction industry faces today makes the Accord not as attainable as it may seem at first glance.

At least it’s “a step in the right direction”. Australian Housing and Urban Research Institute Managing Director, Michael Fotheringham continues to say, “The overarching theme here is that of partnership, by the federal government the states and territories working in a more coordinated cohesive way.” Not to mention the delayed timing, with over a year until the implementation. The Accord doesn’t commence until 2024 allowing enough time to sort through supply chain issues and worker shortages brought on by the pandemic. Mr Fotheringham goes on to say it is a “median term solution”. It takes time and the nature of the property market to do the rest. Possibly indicating there could be at least another 2 years of strong rental growth throughout Australia.

There’s no denying that rental demand is through the roof across the country. This delayed, but necessary Accord, could grant at least another 2 years of strong rental growth, which is great for investors. By the time 1 million homes target is reached in 2029, Australia is not far off from hosting the Olympic Games. Based on current data, it wouldn’t be terrible to presume, another decade of rental growth is still yet to come and perhaps this is just the beginning.

October 2022

We are now entering into a world of heightening interest rates and laws being chopped and changed – all within a tight rental market. If anything, the pandemic has undoubtedly shown us the butterfly effect of the property market. With all these changes and less and less supply of rentals, is now actually the perfect time to be an investor?

Let’s take a look.

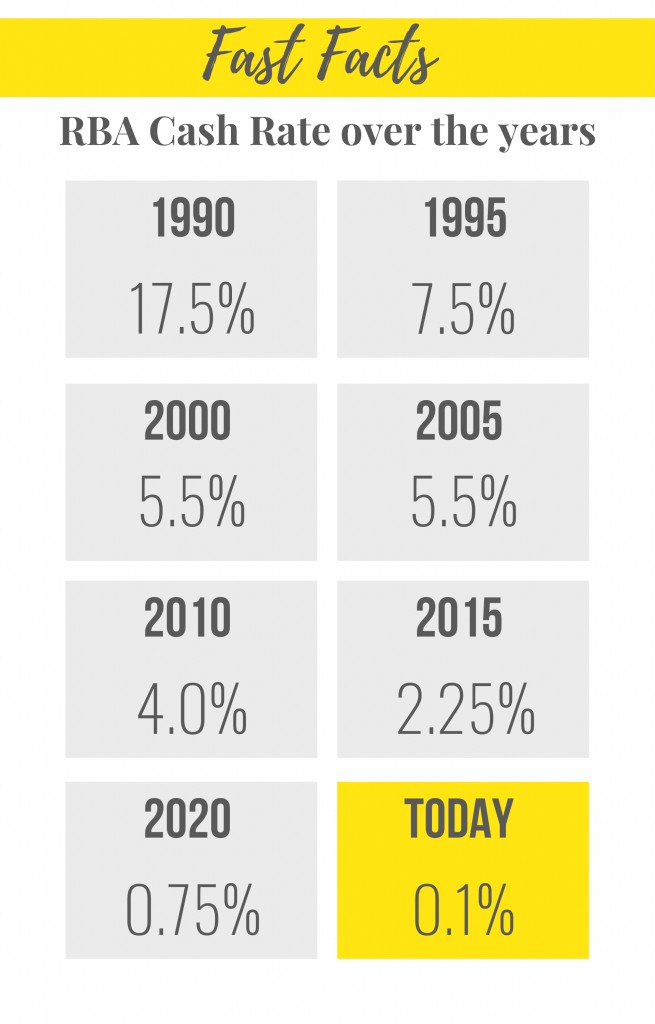

As most are aware, the cash rate has been steadily increasing at regular intervals and this could be causing some buyers to shy away. Property owners have been sitting comfortably for the past 3 years with a cash rate below 1%, and as low as 0.1% in the most recent financial year. As interest rates climb, mortgages are almost doubling. Take a look at Part A of the graphic below showcasing an example of the increase in mortgages this past year. As a possible result, this could create less competition in the property market, making it an opportune time to buy your first investment property or expand your property portfolio

Though, what really shook up investors was the recent announcement of Queensland’s new Land Tax law. This received significant backlash to the point where the government shelved the decision weeks later. Queensland-interstate investors were going to be hit with thousands of dollars of additional land tax each year. However, the law relied heavily on the cooperation of other Australian states. They vocally refused to share personal data of their citizens to the Queensland government. This forced Premier Palaszczuk to withdraw the new land tax law. Having this controversial law now rejected, instills new faith for investors.

Take a look at Part B of the graphic below of what would have been the new land tax charges.

At the same time, Annastacia Palaszczuk announced a change to the planning rules to allow Queenslanders to rent out granny flats in the hope of easing the housing crisis. Palaszczuk states, “I know the rental market is tough and, right now, homeowners can’t rent secondary dwellings to anyone other than immediate family. Changing this will mean many cheaper properties will enter the rental market, helping thousands of people across our state”. Palaszczuk anticipates this ruling to run for 3 years prior to making a long term commitment to the change. This reform simply speaks volumes to our current market of high rents and low vacancy rates, favouring investors.

There are certainly a lot of changes occurring from both a state and federal level affecting the property market. Having the new land tax law quickly spurned has created less stress for investors. Then increasing interest rates is possibly steering away competition. Plus a rental market that doesn’t appear to be slowing down. Seems like no better time than now to own an investment property.

September 2022

Furnished properties have been making more of an appearance in the rental market recently. And investors are asking, should I furnish my property? It’s a question being asked more and more since the Australian borders reopened.

We take a look to see what is the most beneficial to investors.

What is a furnished property?

There can be 2 types of furnished properties, either fully furnished or semi-furnished. Fully furnished includes large furniture items such as dining tables, lounge sets, TV, beds, appliances and white goods. As well as smaller items such as cutlery, kitchen appliances, sheets, pillows and cleaning products. Whereas semi-furnished properties just include the basic large items. When a tenant is looking for a furnished property, they are usually looking for fully furnished but are likely to be flexible.

What is the target market?

Furnished properties can appeal to a few different groups of tenants. The main demographic is university students especially if your investment is located near Queensland University of Technology (QUT) in Brisbane City and Kelvin Grove or the University of Queensland (UQ) in St Lucia. In these instances we find parents pay the rent as a guarantor and the students simply study full time. Furnished properties can also target tenants moving interstate or internationally. They may not want to move all their furniture to their new destination as it can be expensive.

Do they get extra rent?

Prior to border closures in 2020, furnished properties did receive higher rents than unfurnished properties. From 2020 to early 2022, the demand for furnished properties was extremely minimal due to a lack of international and interstate travel. There was an oversupply of furnished properties as short term accommodation was offered on the long term rental market. This was due to a drastic fall in demand for short term stay options such as AirBnB. As a result, prices dropped significantly especially in the inner city. Hundreds of dollars in price reductions were made per property per week to meet demand. Now, the furnished market is starting to achieve pre Covid-19 returns again. Below is a case study for a 2 bedroom 2 bathroom apartment in the same complex comparing an unfurnished and furnished rental return.

Case Study:

2 bedroom, 2 bathroom apartment at 222 Margaret Street, Brisbane City

Unfurnished property could achieve between $600 – $700 per week

Furnished property could achieve between $750 – $900 per week

Does tenant demand change between suburbs?

Brisbane City and surrounding suburbs is an area where the demand for furnished properties is fairly high. 24.8% of properties in the CBD currently for rent are furnished rentals. Whereas the greater region of Brisbane has only 15.3% furnished properties available for rent (as of August 2022). Properties for rent in areas further out don’t tend to increase rental return as much as the inner city market. Usually they could achieve a similar price to if the property was unfurnished.

In summary, demand for investment properties in Brisbane City and immediate surrounds has finally started to increase. Having a furnished property in these areas could be seen as a strong investment now that there is heightened migration. In areas with less furnished demand it doesn’t seem to increase value making these areas more suitable for unfurnished properties. Either way, having an unfurnished or furnished property could still be seen as a good investment in today’s rental market depending on the area.

Take a look at at the statistics below!

August 2022

Location is one of the key foundations for a successful investment. Below we take a look back at what and where Australians used to call home. Is the past any different to what we see today, or perhaps the new working from home trend threw a spanner in the works? Keeping an eye on past and current trends could help determine your next investment.

We dig deep in the history books below to find out!

Where Australians used to live in the early 1900s and why, is not all that different to what we see today. The upper classes lived up high, on hills where it was safe from floods. They were close to churches and shops and had lots of space with separate rooms. The lower class usually lived in small iron houses shipped from overseas. As you can imagine, these houses were extremely open to the elements – freezing in winter and sweltering in summer. Additionally, they were located in low-lying areas, susceptible to floods and heavy rainfall. There are still a portion of Australian houses affected by weather events today, as we have recently seen.

At the close of the 19th century, citizens used to live in either rural or urban areas. If they lived in rural areas, they likely worked with livestock on farms. However, Australia was beginning to evolve into a more developed community where job opportunities in the cities were growing. The new Australian trend was to follow where the work was and enjoy a better lifestyle close to shops, beaches, rivers and parks. Australians were known as heavy drinkers, so more pubs and restaurants were constructed to accommodate the demand. Another attraction was the beach. Laws regarding the ability to swim at the beach was contested in 1904, though prior to this people still walked alongside the water and had picnics in the sand. Much like we see today.

Reflecting on this in the 2000s, Australians have continued to migrate towards plentiful work in city centres. Properties close to the CBD were considered to have the most value as that was where the demand was. Until the onset of ‘working from home’. Then demand shifted to properties further out as people refocused their attention on their surroundings. Residents moved to areas for more space, near waterways and greenspace and with more lifestyle opportunities. Demand and prices began to rise for cities’ middle to outer rim suburbs. Homeowners and tenants alike, wanted studies, views, air conditioning and dual living. Households began to save money with less commuting requirements, allowing them to afford higher rent and upgrade to a more desirable property.

Living close to work was a century trend. Infrastructure was mainly built around concentrated populations and for a long time that was in the city. Now with more people working from home, we’ve seen demand shift significantly. Only the future can tell whether this trend will continue as we move into a post-Covid world.

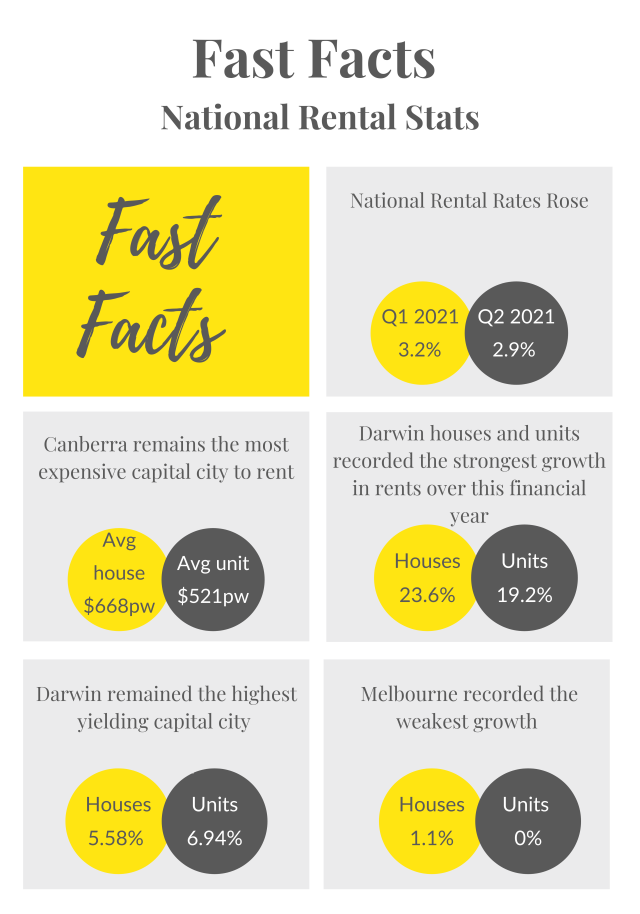

Check out the shift in rental market stats below!

July 2022

Brisbane, and the vast majority of the country, is experiencing the tightest rental market in years. It’s all over the news and they’re calling it a ‘rental boom’. But, it hasn’t all happened overnight. In fact, Brisbane’s current rental climate has been several years in the making.

Let’s take a look below, at some of the contributing factors.

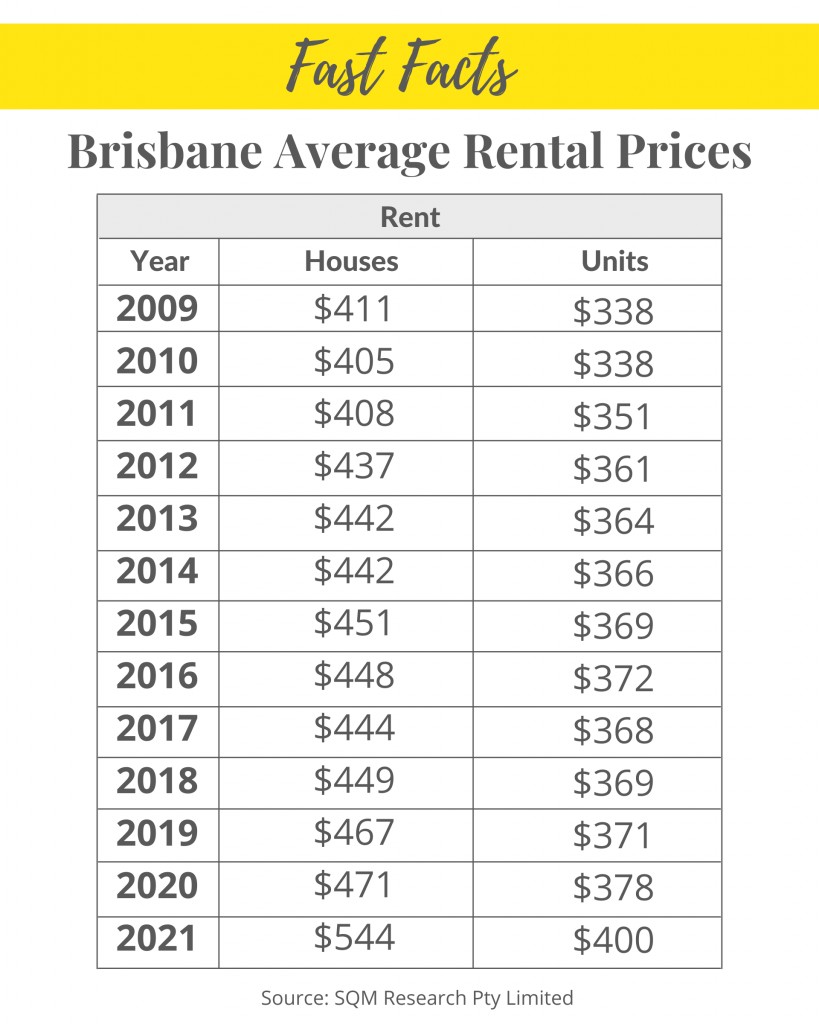

Brisbane’s current vacancy rate is 0.7%, the lowest in recorded history. As a result of this, rental prices are soaring. In the past 12 months, Brisbane’s median house rent has increased by 12.2% and units by 7.2%. The current rental boom has been built on soaring demand and limited supply. Not only are tenants experiencing increased rents but they are also up against stronger competition. Tenants with the most favourable applications are securing rentals. Those who may not have a picture-perfect application are having to move to less desirable accommodation.

With new rental listings at an all-time low, we are experiencing extremely little availability of rental properties. Since the height of the oversupply of apartments in 2016, stock has been on a steady decline. 2015 saw 12,200 new apartments built, 2016 with 11,000 new apartments built and just 2,300 new apartments built in 2021. This is down 79% from the peak in 2016. Another factor contributing to low stock is stringent lending provisions for investors. In 2017, tightened loan criteria was implemented, requiring investors to produce a larger deposit. Following this was the 2019 election which proposed the removal of the negatively geared property tax benefit. Although this never passed it caused uncertainty and resulted in cautious investors. Lastly, we have seen many investors sell this year, cashing out at the peak of the market. Interestingly, the majority of buyers were owner occupiers with an increase in first home buyers in the market. This has caused a reduced level of investment stock over time creating less property investment supply.

When looking at the property market, it’s important to consider both supply and demand factors. The current lack of rental property supply seems to be the result of various conditions snowballing over the years, though heightened tenant demand is fairly recent. Queensland’s increased demand has largely been seen from the impacts of Covid-19. With the majority of the west coast’s interstate migration arriving into Queensland, Brisbane’s tenant demand has increased by 32.2% in the past 12 months. Now with international borders reopening, it’s possible this could rise even further over the next year.

Looking at these statistics, It is a great time to be an investor. With less worry about vacancy, high returns on investments and having ample choice of applicants. As well as, researchers largely anticipate this market could continue for years to come. This year was certainly a year for the history books. We will be watching what the next 12 months brings with anticipation!

Check out our rental market stats below!

June 2022

It seems not a day goes by without the media talking about housing affordability and the under-pressure construction sector. Whether you are building, renovating, or doing nothing at all – there is no doubt this issue has an effect on the real estate market. Here’s why…

Clients of construction companies are experiencing price increases between $40,000 to $100,000 on top of their agreed building contract amount. And if payment isn’t made, the house won’t get built. Of course consumers have no other option but to accept the higher price. In previous years this wasn’t the case, building companies were entering into fixed rate contracts, and it hasn’t been an issue until now.

Construction companies, big and small, who had previously been locked into fixed rate building contracts had no room to ask for more money. Companies were sometimes breaking even or taking a hit financially. There are 2 large building companies who have recently gone into liquidation as a result: Gold Coast construction company, Condev, and a major Australia wide industry player, Probuild. Probuild has been developing 443 Queen Street, Brisbane and has now stopped work. Assistant state secretary Jade Ingham said, “160 workers on the 443 Queen Street site have been left without work. Some of their employees may have other work for them to go to, many won’t.” He said “there were around 20 subcontracting firms associated with the Queen Street build, with between four and six months of work left to complete the major apartment complex.” Mr Ingham added that anywhere between $7 to $10 million was owed to subcontractors.

Now in recent news, is the large eastern Australian building company, Metricon, possibly on the brink of collapse? It was reported that Metricon was in emergency talks with clients after falling into financial strife with the approximately 4000 homes they currently have under construction. The only real solution for building companies to stay afloat is to increase prices for customers.

However, are the building companies all to blame? Construction companies are experiencing increased supply costs as a repercussion of Covid-19. It is difficult to get stock from suppliers which of course increases demand and prices go up in response. This is coupled with already spiked supply costs as a result of growing inflation throughout Australia. The only option for survival is increased prices.

It’s all about matching the market and if consumers want their house built, there’s a new price tag to go with it. Researchers say construction cost inflation could continue for the next 12 to 24 months. This will ultimately be passed onto consumers putting an upwards pressure on the value of newer builds and renovated homes. The rise of construction costs has come when Australians are already facing challenges of increased housing prices and inflation. There is reason to believe housing prices could continue to grow, as long as construction companies stay at the forefront of supply chain issues and national inflation.

Check out our stats below!

May 2022

On the 1st of October 2022, all the anticipated rental reforms for QLD will commence. Below is everything you need to know to prepare and more!

The date has been set!

QLD rental reforms commencing 1st of October 2022.

Ending a Lease

Current legislation: An owner/property manager is able to end a fixed term lease or a periodic lease (commonly known as ‘month to month’) without grounds, providing tenants with 2 months notice.

New legislation: An owner/property manager is able to end a fixed term lease without grounds, providing tenants with 2 months notice.

An owner/property manager is able to end a periodic lease only under the below 3 grounds:

- Owner selling the property

- Owner renovating the property

- Owner moving back in

This new legislation allows no room for error when it comes to the lease renewal process. When a fixed term agreement is not renewed, it immediately rolls onto a periodic lease. After the 1st of October this year, if this occurs it becomes extremely difficult to remove tenants if they are not the best fit for your property. Essentially, on a periodic lease, owners/property managers will lose a lot of control over their investment. Having a property manager that is on top of their lease renewal processes has never been more paramount.

Renting with pets

Current legislation: An owner/property manager has total discretion whether to allow pets to be kept at the premises.

New legislation: A tenant can seek the property owner’s permission to keep a pet, and a property owner can only refuse a request on identified reasonable grounds, such as keeping the pet would breach laws or by-laws. A response needs to be provided to the tenant within 14 days, otherwise consent is deemed given. The new legislation covers the owner such that providing approval to keep a pet may include reasonable conditions, like requiring the pet to be kept outside. However, a pet bond is not a reasonable condition. Also, it is outlined that damage caused by a pet is not fair wear and tear on a property and that the tenant is responsible for any and all pet damage.

The wording of this legislation leaves room for interpretation – “on reasonable grounds”.

The only definite reason to refuse a pet included in the wording of the legislation is through the use of Body Corporate by-laws. When looking at houses, the line is fairly blurry on saying ‘no’ to pets. We will be monitoring case studies, once the legislation is in action, to try and get a clearer understanding of where the line is drawn.

Minimum housing standards

Current legislation: A tenant has 3days from their lease start date to return the Entry Condition Report.

A owner/property manager must prepare to fix items included in the property. Example, if a dishwasher was included at the commencement of the lease and it breaks down during the tenancy, the owner must repair/replace the dishwasher to a working standard again. A tenant can request maintenance items to be fixed, however an owner/property is not required to fix it if the liveability of the property isn’t affected.

New legislation (Stage 1): A renter has 7 days from their lease start date to return the Entry Condition Report. Tenants can seek QCAT orders, enforced by the RTA, including that the property can’t be rented or allowing reduced rent until repairs and maintenance are completed.

New legislation (Stage 2): Commencing 1st of September 2023.

Rental properties must comply with Minimum Housing Standards when a new lease is entered into from 1 September 2023.

This includes:

- the premises to be weatherproof and structurally sound

- fixtures and fittings to be in good repair and not likely to cause injury to a person

- locks on windows and doors

- the premises to be free of vermin, damp and mould

- privacy coverings

- adequate plumbing and drainage

- functioning kitchen and laundry facilities (where supplied)

New legislation (Stage 3): Commencing 1st of September 2024.

All rental properties must comply with Minimum Housing Standards from 1 September 2024.

It seems due to the severity of this reform and to allow time for owners to prepare financially, it is being introduced in 3 stages. The premise is to ensure all properties are safe, secure & functional for renters. As investors, if you don’t already, it may be ideal to ensure your budget for outgoing maintenance expenses is sufficient to comply with the incoming rental legislation.

All of these legislative changes could create less supply of, and higher demand for, rental properties, possibly increasing rental prices even more.

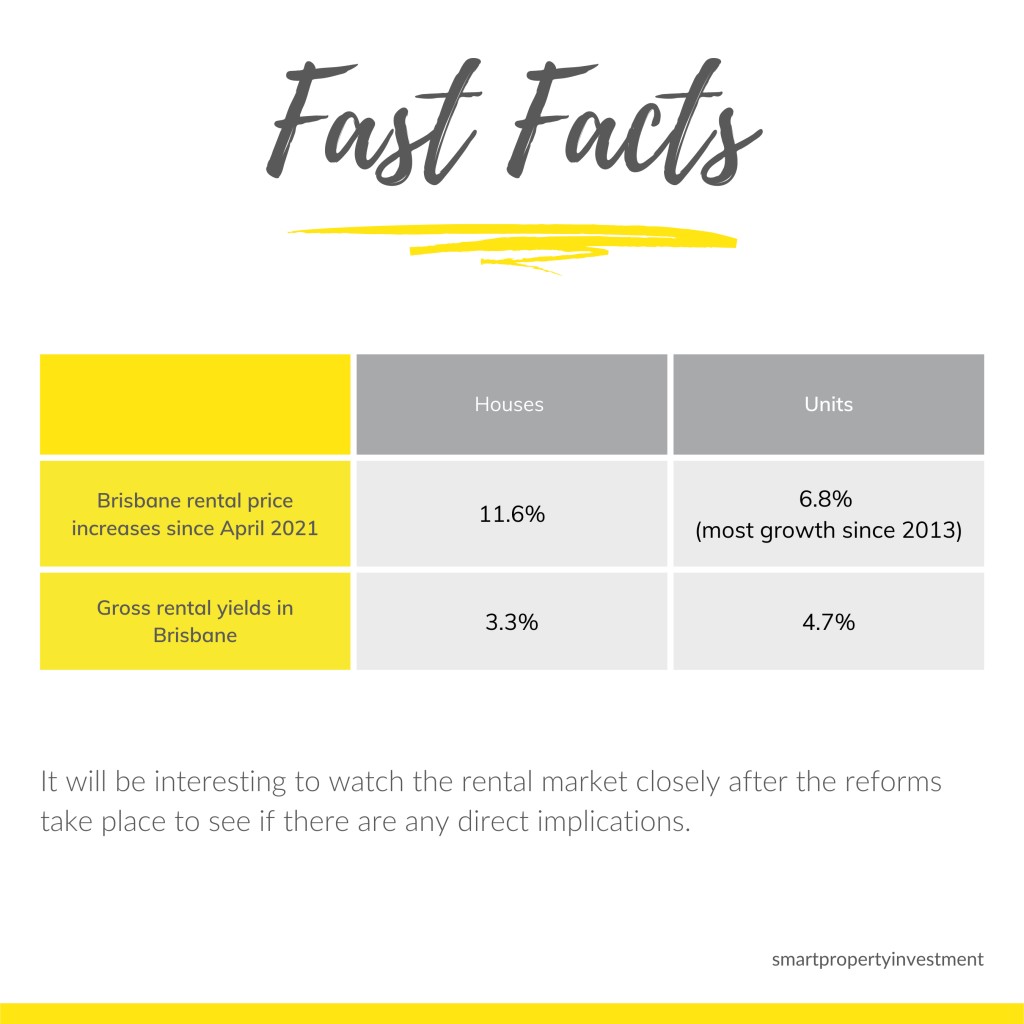

Take a look below at how the rental market in Brisbane has performed over the past 12 months!

April 2022

Floods and the effect on the property market?

Brisbane saw property values reduce significantly, and almost immediately, after the last major flood event in 2011. CoreLogic’s analyst Eliza Owen found that property prices across Brisbane fell by 6.1% in the 12 months after the floods. And some suburbs fell a whopping 18%; prices with the steepest declines were reported in Chelmer, Rocklea, Graceville, Yeerongpilly, Fairfield, Fig Tree Pocket, Indooroopilly, and Kenmore. Not only were property prices affected almost immediately after the event, but research also shows the worst affected suburbs took three to nine years to recover.

However, Owen explains that it is extremely difficult to isolate the direct impact of property prices to the 2011 floods. “This decline was triggered by a tightening in monetary policy amid a resources boom, and Australia’s recovery from the GFC (Global Financial Crisis).” Before the GFC, interest rates were already at an all-time high, we saw strong inflation and as a result, house prices were dropping. Throw in a natural disaster after the economy slowly began to recover, morals dropped again as Brisbane citizens rolled up their sleeves for another financial fight.

Though, today’s economic situation might just be the polar opposite. Australia has been experiencing a housing boom and before the 2022 floods, the Brisbane housing market had an increase of 8.5% in the quarter to December 31st 2021; the strongest state growth nationwide. Compared to 2011, we are currently experiencing ultra-low interest rates and relative economic stability. Real estate research analyst Terry Ryder said “The disaster may have a psychological impact on people who were poised to buy in the city.” He believes the market will recover more quickly than it did following the 2011 floods. With the housing growth leading up to the event alone, some could say it’s fair to assume Brisbane won’t see any material long term impacts on the housing market.

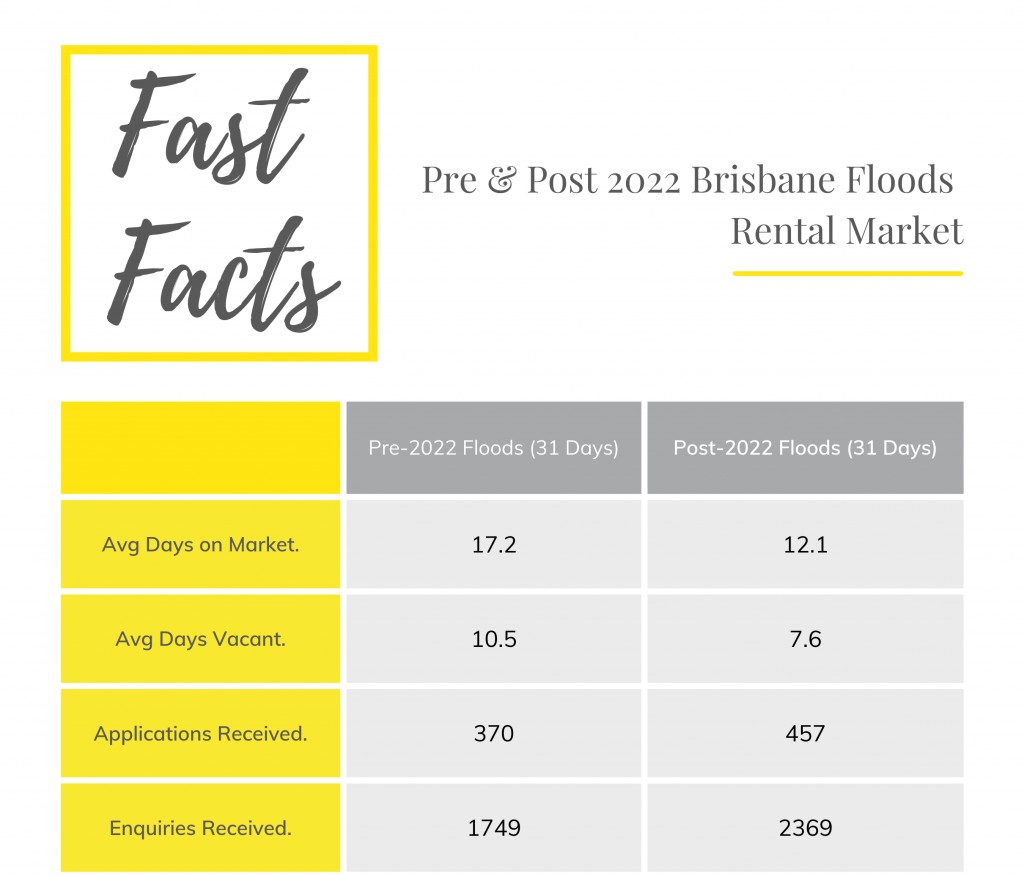

The Brisbane rental market had already grown significantly amid the pandemic. Now, with many tenants and owners alike having to vacate flood damaged properties and those properties waiting for repairs, we are seeing subdued rental stock and heightened demand and this could put further upwards pressure on rental prices. We had a look at Ray White Alderley’s rental activity directly before and after the 2022 Brisbane floods. See our stats below!

March 2022

Which investment is the best investment?

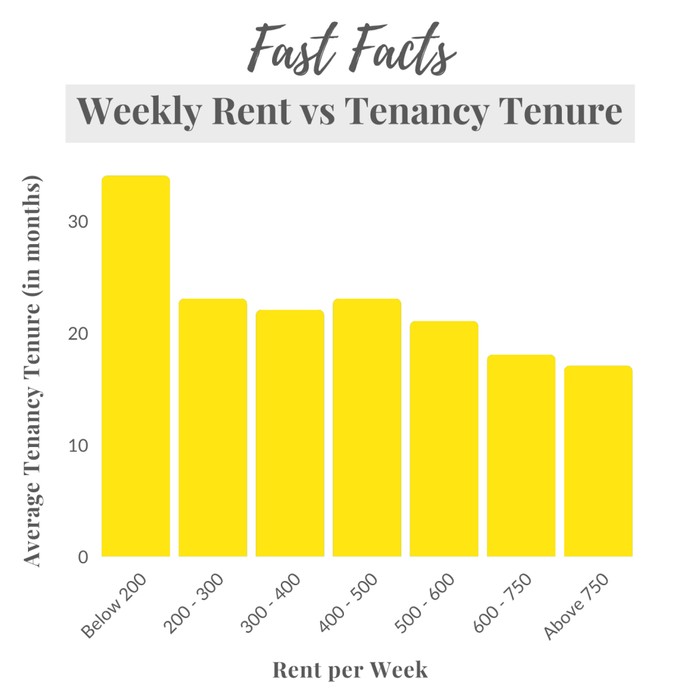

As savvy investors, we usually look at two key elements when choosing an investment property – rental yields and capital growth. These are both hugely important factors, but aside from that, could longer term tenants and fewer letting fees contribute to a better return on your investment? We investigated whether rental price affects tenancy tenure and thus the frequency of letting fees. Take a look at our findings below.

February 2022

In the past, buying land and building a house has been the best economic choice, in most cases. However, with increasing building costs and land prices, is this still the case? Let’s examine the pros and cons of buying built vs building an investment house:

Building An Investment Property

Advantages:

- Control over the specific style and layout of build

- Brand new appliances and fittings

- Less maintenance upkeep and expenses

Disadvantages:

- Construction period before the property begins to generate a rental income

- More work involved by the investor deciding the design

- Expenses may go over budget with the possibility of building delays

- Limited land available in Brisbane’s inner city rim – May have to knock down & rebuild, attracting added costs

Land value can vary significantly by location. In Brisbane’s inner city rim, land prices average around $600,000 – $700,000 for 405m2. The current construction cost to build a 4 bedroom, 2 bathroom, 2 car base line home starts from $450,000. Assuming there are no demolition costs or council fees, the total cost to build a house is about $1,150,000.

Buying A Newly Built Investment Property

Advantages:

- Can produce rental income immediately

- Brand new appliances and fittings

- Less maintenance upkeep and expenses

- Convenience factor – less work/time involved for the investor

Disadvantages:

- Higher price for ease of convenience and property market growth

- Choice of location and style of house can be limited

When looking at recent sales of newly built houses it’s important to take into consideration the differences in initial land value and building style that can largely affect its overall value.70 Fanny Street, Annerley, a 4 bedroom, 2 bathroom, 2 car house on 453m2, sold for $1.4M in January 2022. Another newly built house at72 Khartoum Street, Gordon Park sold in October 2021 for $1.67M on a 405m2 block.

Depending on your current situation and investment strategy, there are multiple pros and cons to buying built or building an investment property. There is plenty of tenant demand for newly built houses and either way there will be at least less maintenance to worry about!

Take a look at the graphic below.

January 2022

Brisbane Rental Price Trends

December 2021

Interest rates set to shock the market?

November 2021

New Tenancy Legislation – A Doggy’s Dream?

Dogs, cats, birds, fish? Approval of pets. It’s the law getting the most attention and creating much distress amongst property investors.

“A renter can seek the property owner’s permission to keep a pet, and property owners can only refuse a request on identified reasonable grounds, such as keeping the pet would breach laws or by-laws.” The property does also need to be suitable for the pet, i.e. with fences, reasonable size yard. So, for owners of a unit or townhouse, pet approval power still remains with the body corporate committee. However, for most others it means a blanket ‘no pets’ policy is no longer an option. Note, it is still unknown when this change will come into effect.

Likewise changes to ending a tenancy ‘fairly’ have been passed but not yet implemented. Property owners can no longer end a tenancy, simply ‘without grounds’. New grounds to end a tenancy are as follows:

- The end of a fixed term tenancy agreement

- Need to undertake significant repair or renovation

- Change of use (owner moving in) or sale or preparation for sale of the rental property requires vacant possession

A serious breach (eg. rent arrears or damage) remains a valid reason for eviction. What this means is, it will become more difficult to replace a tenancy on a periodic lease as the grounds of ‘end of a fixed term tenancy agreement’ don’t apply. For a periodic agreement, it won’t be possible to end such a tenancy easily unless the owner wants to renovate, sell or move into the property.

Also, domestic violence victims can break their lease with 1 weeks notice and replace locks without owner approval. This emergency COVID legislation has been made permanent and is already in effect. As well as a reform to ensure properties of sound condition, set to commence in September 2023.

These changes do give tenants more security but it removes some power from property owners in terms of control over their valuable investments. Moving forward – now more than ever – with all the forthcoming legislation changes, a well-informed and experienced property manager is imperative. Your property manager needs to wholly understand the new legislation in order to look after your best interests and protect your largest asset.

Take a look at the statistics below…

October 2021

Sale prices for houses in Brisbane are booming but do we see the same trend for apartments? Dive into the details below!

The House vs Apartment Price Gap

In Queensland, our residential preferences have always shown houses to be more popular than apartments and this has only been reinforced in recent times. The price gap between houses and apartments in Brisbane has drastically increased since the onset of Covid-19 to a record high of 58%. In particular, inner city apartments are in severe oversupply, classified as a high risk investment for both equity and cash flow. However, is this all about to take a turn?

We see two major factors contributing to the possibility of a price gap reduction between houses and apartments.

- Apartment construction throughout Brisbane rose substantially around 2016, creating an oversupply of stock as fewer investor buyers were present in the market. Fast forward to today, we are now seeing construction costs significantly increase, lowering demand for new high rise apartment buildings. This directly correlates to an increase in apartment prices.

- Brisbane has already seen over 23,000 interstate arrivals in the past year. With international borders anticipated to slowly reopen soon, we expect to see a large amount of overseas migration. Many immigrants will desire to live close to Brisbane CBD and inner-city universities. Given the soaring house prices we are experiencing, renting or purchasing well-positioned apartments will likely be the most feasible and affordable options.

We all know that houses in Brisbane are achieving higher and higher prices every day with little evidence of slowing down. House prices have been consistently rising with an average monthly growth of 2% since the start of the year. Whereas, apartment prices have been at more of a standstill with an average increase of 0.8%. However, apartment prices have risen 1.4% for the month of August. Is this just the beginning of a strongly anticipated price gap beginning to narrow?

Top tips for investing in an apartment:

- Livability

- Location

- Spaciousness

- Has an outdoor area

- Properties located within 10km from the CBD

- Has a train line nearby

- In a highly desirable school catchment

- Household income in the area is well above the Queensland average

September 2021

Everyone has surely heard by now – Brisbane is officially the host of the 2032 Olympics! Let’s take a look at whether holding the Olympic Games actually influences host cities’ property prices.

Brisbane Olympic Games vs Property Market

When speaking to investors recently, they are advising, “I’m purchasing this property because the Brisbane Games is approaching” or “Instead of selling my investment property in this heightened market, I’ll hold onto it for another 11-12 years.” But what effects have we seen in the past to support these hopeful forecasters?

Barcelona hosted the Olympic Games in 1992 and saw an increase of 130% in property prices over the 5 years leading up to the event. The city underwent major renovations with the addition of the Alta Velocidad Española, a high speed train line connecting to Madrid. As well as a revitalization of the city’s waterfront district, this no doubt contributed to the price spike.

Sydney hosted the 2000 Olympic Games and saw the property market increase by 88% over a 5 year period. $6.6B was spent on improving infrastructure and transportation. However, the reason for this housing market boom was the great economic prosperity that Australia experienced around this time. During this 5 year period, influences such as tax reform (GST), large property buyer grants, a global technology boom and unprecedented economic development occurred independent of the Games.

London hosted the Olympic Games in 2012 and saw housing prices increase 38% over 5 years. The impact of this boom is significantly lessened by the enormous $16 billion expense of preparing to host.

Brisbane will host the 2032 Olympic Games.

It’s yet to be determined how Brisbane will be impacted by the Olympic Games. “The traditional seven years from announcement to event date has been extended to 11 years, thereby further diluting the investment.” says Simon Pressley, Head of Research at Propertyology.

South-East Queensland already has plenty of existing infrastructure since hosting the 2018 Gold Coast Commonwealth Games. As such, the cost of preparations has reportedly been advised to be lower other cities’ spending, estimated at $4.5billion.

Property owners should not bank on the Olympics to stimulate high growth in the residential market. In reality, refurbishment projects and upgrades to transport and other services and facilities could have a beneficial impact on property prices, not necessarily from the Olympics. Instead, Pressley advises “to focus on the Olympics for what they are: a fantastic display of talent, sportsmanship and national pride”.

August 2021

This month we dive into how the newly proposed Housing Legislation can affect your power as an investor. Will tenants gain more rights than landlords?

QLD Housing Legislation Amendment Bill

Buying your first investment property today could soon have a different impact for the future than expected. The Queensland Government has recently introduced their Housing Legislation Amendment Bill 2021, awaiting parliament approval. How will this edition of the Bill impact investors? Take a look below:

- Having a Fixed Term lease in place has always been a crucial recommendation from property managers, however it may become more crucial than ever. If a lease expires and rolls over to a periodic agreement, you’ll no longer be able to ask your tenant to vacate without grounds, or at least have very strict limitations around the Notice to Leave requirements.

- Landlords will no longer be able to refuse pets, without adequate reasons. Yes, your property still has to be appropriate and suitable for the certain pet, however if you own a house with a yard & fencing, its likely that saying ‘no’ is in the past. And you won’t be able to ask for more bond or rent to accommodate the higher risk of damage.

- Ensuring your property is ‘ready to rent’ is next on the chopping block. Any evidence of vermin, dampness and mould must be remedied prior to a tenant moving in and managed promptly throughout the tenancy.

Predictions suggest that a higher amount of property investors may sell in order to put their money into a more investor controlled environment. This would mean less rental properties available, the same high demand and as a result rent prices will increase.

See further insights and information on the bill here: Rental Law Reform – Housing Legislation Amendment Bill 2021.

Now more than ever, it’s important to have the best advice on investment opportunities and a knowledgeable property manager to guide you through these proposed changes!

July 2021

Happy New Financial Year! So far, 2021 has been an exciting year for real estate and we have seen unprecedented growth in the Brisbane property market.

- January-March quarter growth of 5.31%

- Annual growth of 8.22%

- Ashgrove is Brisbane’s newest member of the Million Dollar Club. With an increase in median house value of 19.69% now sitting pretty at $1,207,524 (from $969,899)

Is it safe to say these numbers are expected to be the norm now? Who will be in Brisbane’s Million Dollar Club next year?